THOSE PESKY FALSE BREAKOUTS- WHAT DO WE DO?

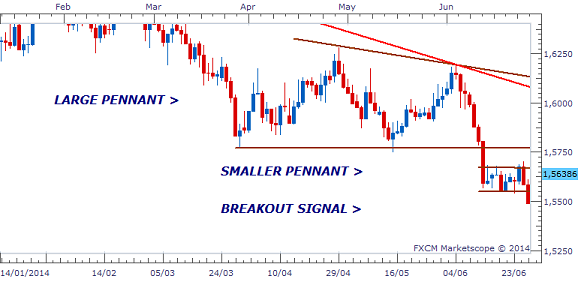

False breakouts are one of the necessary evils of the Forex market. Signals that appear to indicate the start of large gains for the trader often turn out to be broken promises that lead to unexpected losses. Spotting the signs that actually give a heads-up as to the potential for these reversals helps to avoid these scenarios that arise during long periods of market indecision and low liquidity. Take the recent movements of the EURO NZD and the GBP AUD as examples. These both gave bearish signals that broke the Support of their respective Consolidations that had formed below larger Pennants setups. Given that these smaller Consolidations represented a test of the Support of these broken Pennants, gains of several hundred pips would have been expected. EURO NZD - DAILY CHART Source: FXCM Marketscope DAILY CHART- GBP CAD Source: FXCM Marketscope Nevertheless, the candles that broke these setups were not strong enough to justify ent...