GBP CAD PROVIDES A 140-PIP TRADING GAIN FROM FALSE CONSOLIDATION BREAKOUT REVERSAL

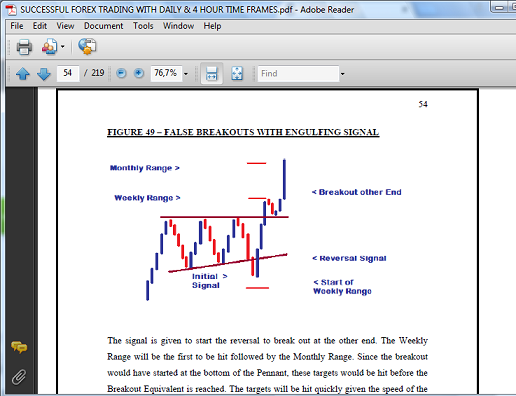

This successful trade took advantage of the sharp False Breakout Reversal from the Pennant Consolidation on the Daily Chart that started on December 3, 2015. As with all of these types of setups, the initial breakout attempt was quickly taken out by a strong, opposing signal that led to a breakout at the other end of the Consolidation. Given that this setup was in sync with the theory of False Breakouts that is outlined on Page 54 of the Trading Manual, the trade provided a strong gain of 140 Pips. The graph below shows one of the examples of False Breakouts that are explained in detail in the Manual. FALSE BREAKOUT SETUPS As you can see from the Daily Chart of the GBP CAD below, the setup was almost exactly the same as the one above. DAILY CHART FALSE BREAKOUT PENNANT SETUP (FXCM Charts used to provide Entry Signals based on the New York Candle Close of the Daily Chart) Following the Bear Candle that attempted a breakout at Support, the bu...