AUD USD - STRONG RALLY OR FALSE BREAKOUT AHEAD?

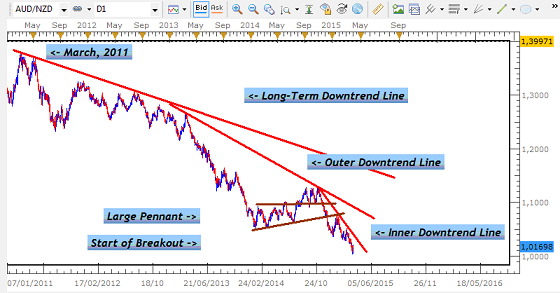

The Range Setup on this pair was finally broken with a strong bull candle breakout signal. This signal - a Normal Candle - has also broken the strong Downtrend Line that was formed with the breakout from the large Pennant Setup started in November of 2014. Given these strong bullish technical signals that point to the start of a strong breakout, many traders would be getting ready to capture hundreds of Pips from this expected rally. However, as attractive as this setup is, there a 3 other important, more dominant technical factors that may lead to either a False Breakout or a breakout that is volatile and risky to trade. The breakout candle that was given on Monday April 28 can be seen in the Daily Chart below. DAILY CHART- BREAKOUT SIGNAL From Section 8 of the 2nd Part of the Trading Manual, we can see that this candle which broke above the Resistance, complies with all of the requirements of a Normal Candle that would usually make this a tradeable setup. ...