USD CAD WEEKLY ANALYSIS

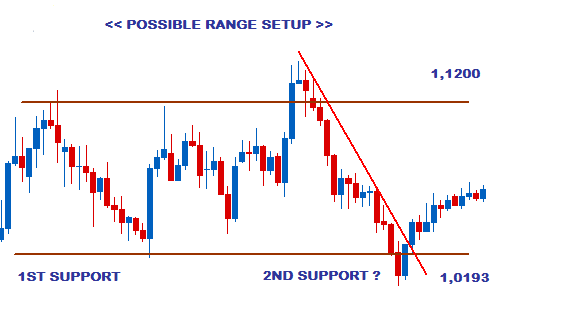

POSSIBLE RANGE SETUP FOR THE LOONIE-GREENBACK

A downtrend line has already been broken within this possible Range setup and if the current rally taking place at the 1,0913 area continues to the Resistance boundary, the Range will be complete. Such a move long could also provide over 100 pips in trading opportunity.

RECENT EMAIL FROM CLIENT

Consolidation seems to be the common setup for most of the popular currency pairs recently and the USD CAD does not want to be the odd one out. Daily Chart below shows that the Resistance area has already been formed for the possible Range at 1,1200, with the 2nd Support point needing to be formed to complete the setup.

DAILY CHART

A downtrend line has already been broken within this possible Range setup and if the current rally taking place at the 1,0913 area continues to the Resistance boundary, the Range will be complete. Such a move long could also provide over 100 pips in trading opportunity.

Only time will tell what happens, as with setups such as these, Double Bottoms could also be formed before it reaches Resistance.

Cautious trading on this one would be recommended.

RECENT EMAIL FROM CLIENT

____________________________________________________

SUBSCRIBE TODAY

_____________________________________________________________

Comments

Post a Comment