100 PIPS AND A 5% RATE OF RETURN ON GBP JPY - IN JUST 5 HOURS

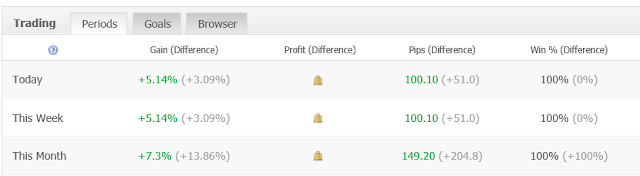

This trade provided an aggressive gain of 100 Pips in a very short time to push the overall Return for February to 7.34% following the 2.05% gain on the AUD NZD last week (see previous Blog Post). The trade also coincided with general Yen gains across the Forex that were in sync with global safe haven trading activity on Monday.

With this result so early in the month, the target of 14% for February is increasingly becoming likely once the market continues to provide these profitable, High Probability Setups in keeping with my Trading Strategy.

With this result so early in the month, the target of 14% for February is increasingly becoming likely once the market continues to provide these profitable, High Probability Setups in keeping with my Trading Strategy.

SUMMARY OF TRADE & MONTHLY TARGETS

This rate of return is the goal of the strategy which was used in December in the Dukascopy Contest in the last month of testing of this new strategy. Having achieved a 28% Return from just a few trades...

|

..achieving these returns over the next 6 months is very likely to be realized - for me and Subscribers to my World Class Mentoring Service.

THE GBP JPY TRADE SETUP - PENNANT CONSOLIDATION DAILY CHART

Based on the nature of the Bullish and Bearish patterns that had been formed so far on the Daily Chart Time Frame, it was very likely that a Pennant Consolidation Setup on both this time frame and the 4 Hour Chart was being formed. To carry out this expected movement, the 4 Hour Chart provided a Bear Crown /Head & Shoulders Pattern to resume the transition from an Uptrend to a Downtrend and provide the Entry Signal to take advantage of this decline.

DAILY CHART CONSOLIDATION PENNANT SETUP

4 HOUR CHART PENNANT SETUP

4 HOUR CHART BEAR CROWN & ENTRY SETUP

|

| Bear Crown/Head & Shoulders (HS), Left Tip (TP), Right Tip (RT), Centre Tip (CT) |

After ensuring that the setup conformed to the Rules for my Strategy, an Entry Order was placed to get in at an ideal price...

After triggering the Entry Order to take me into the trade, in just 5 hours, the trading target was hit as the market declined aggressively in favour of the Japanese Yen across the Currency Market.

4 HOUR CHART SHARP DECLINE AS EXPECTED

The result of this trade can also seen here on my Live Account with FXPro (FXCM Charts are used for Chart Analysis, FXPro used for trade execution).

After triggering the Entry Order to take me into the trade, in just 5 hours, the trading target was hit as the market declined aggressively in favour of the Japanese Yen across the Currency Market.

4 HOUR CHART SHARP DECLINE AS EXPECTED

The result of this trade can also seen here on my Live Account with FXPro (FXCM Charts are used for Chart Analysis, FXPro used for trade execution).

LIVE ACCOUNT 4 HOUR CHART TRADE RESULT

So yet another great example of how we can profit from these trade setups on the reliable Larger Time Frames, by Swing Trading with powerful Japanese Candlestick Signals. You no longer have to wait until a Consolidation has been formed to trade these waves or the breakout that eventually takes place. So long as we can spot these movements early enough and are provided with reliable signals, additional turmover can be realized from these profitable trading opportunities.

EXAMPLES OF HIGH PROBABILITY CANDLESTICK SIGNALS FROM THE TRADING MANUAL

MAIN TECHNICAL FACTORS INVOLVED IN TRADE

1. Bearish Candlestick Signals & Bear Crowns

For both Trends and Consolidations, Japanese Candlestick Signals provide us with market direction with greater reliability than Statistical Indicators, especially when used on the Larger Charts.

In this trade, the Bearish Signal known as a Bearish Engulfing Candlestick Signal (see above) was identified to indicate the start of the decline to Support as part of the Bear Crown Setup that indicates a Major Trend Change is taking place.

2. Anticipation of Consolidation Setups

The market forms Consolidation Patterns by providing specific types of Bullish and Bearish Waves that tell us that this setup is being formed (see Part 2 of Trading Manual). Once we can spot these waves early enough, we can trade them for strong gains so long as reliable Candlestick Signals are provided with safe Stop Loss Areas.

3. Trading between Support & Resistance

This is a popular Forex strategy that involves buying and selling between these two price boundaries within Consolidations. For this trade, trading was done by opening a short position at that Bearish Signal and then exiting at an area where the market was expected to UTurn to create a Support Point as part of the formation of the Support Boundary and overall Consolidation.

4. The 1 Hour Chart for Stop Loss Placement

As described in the next section, once the Daily Chart provides the Signal to indicate market direction, the 4 Hour Chart is used for Stop Loss placement during the trade. However in some cases as with this trade, a Trend Line on the 1 Hour Chart was deemed to be strong enough to use to protect the trade.

5. Trend Lines used for Stop Losses

For this trade, the Downtrend Line was used to protect the trade against temporary reversals. Once the trend and Trendlines are strong enough on the 1 Hour Chart, they can be used instead of the 4 Hour Chart if doing so allows us to enter the market with smaller Stop Losses.

6. Market Conditions & Trading Strategies

With the narrowing of the Exchange Rate bands within which most currencies are being allowed to move, this has led to the formation of more Consolidation Setups on the Larger Charts but fewer instances of breakouts from them. This has led to a need to focus more on trading within these setups instead of hoping for large payoffs from major beeakouts.

7. Short Holding Periods for Peace of Mind

With my Trading Strategy, you only need to 24 Hours on average for your trading targets to be hit. This reduces the stress of holding trades for several days in a market that can change in the blink of an eye. You can easily return to your 9-5 routine while the market does all the hard work to give you your just reward for another great trade.

________________________________

Happy Trading

Your Mentor

Duane

DRFXTRADING

________________________________

OR

________________________________

________________________________

CLEAR AND DEFINED LEARNING OUTCOMES

________________________________

________________________________

________________________________

1. YOU WILL EXPERIENCE TRADING ACCURACY BEYOND THE COMPETITION

________________________________

NZD CHF CONSOLIDATION BREAKOUT IN JANUARY 2015

ACCURATE EXIT AHEAD OF THE SWISS NATIONAL BANK "SHOCKER" - JUST A FEW DAYS LATER

|

| (See full description of this trade here New Year off to a Flying Start - 231 Pips & 194 Pips on NZD CHF Trade & more Financial Crisis trade results here 200 Pip Targets Still Hit During Financial Crisis ) |

Candlestick Patterns accurately identify the best Trading Targets ahead of both Normal and Abnormal Market Reversals.

________________________________

2. YOU WILL TAKE ADVANTAGE OF STRESS-FREE, INDICATOR-FREE SWING TRADING

________________________________

Instead of using Complicated Statistical Indicators or volatile Economic Data, the more reliable Japanese Candlestick Signals of the Daily and 4 Hour Charts are used to predict and trade the Weekly Direction of Currency Pairs.

________________________________

3. YOU WILL ENJOY TRADING WITH AN AGGRESSIVE 24-HOUR STRATEGY

_______________________________

Despite these great results, a more aggressive strategy is now being used beginning February 1st, 2018.

________________________________

4. YOU WILL LEARN ABOUT THE WEEKLY RANGES OF CURRENCY PAIRS

________________________________

The First Step in Swing Trading the Forex with me is to accurately predict the Weekly Range Direction of the major Currency Pairs.

All Currency Pairs have Weekly Ranges which is their average Exchange Rate Price Movements expressed in Pips over 5 to 7 Days. Trading is then done in this direction to capture our Pip Targets according to our Swing Trading Strategy.

________________________________

5. YOU WILL LEARN ABOUT TRENDS & THE PATTERNS THAT LEAD TO TREND CHANGES

________________________________

6. YOU WILL LEARN HOW TO IDENTIFY CONSOLIDATION BOUNDARIES

________________________________

There are many schools of thought on how to draw Consolidation Support and Resistance Lines. However, the "Line of Best Fit" method is the only way to do this accurately.

________________________________

7. YOU WILL LEARN HOW TO PREDICT & TRADE FALSE CONSOLIDATION BREAKOUTS

________________________________

Instead of losing due to unexpected Consolidation Market Reversals, we can master and profit from them once we understand their Structure and the Candlestick Signals that start them.

________________________________

8. YOU WILL LEARN HOW TO PREDICT THE FORMATION OF CONSOLIDATIONS

________________________________

9. YOU WILL LEARN TRADING TECHNIQUES THAT HAVE WON CONTEST PRIZES

________________________________

________________________________

10. YOU WILL HAVE A MENTOR WITH A TRACKED & VERIFIED LIVE FOREX ACCOUNT

________________________________

|

| Reflects the performance of the strategy since it began in February 2018. |

At 10.18% from just 4 trades since February 2018, only a few trades are left to hit the first target of 14% before moving on to the next major targets.

________________________________

THE COMPREHENSIVE TRADING & MENTORING SERVICE

________________________________

________________________________

EXAMPLE OF VIDEOS YOU WILL RECEIVE PRIVATELY EACH DAY

________________________________

________________________________

WHO WILL BENEFIT THE MOST FROM THIS MENTORING SERVICE?

________________________________

Day Traders Looking to Switch to the Stability of the Higher Time Frames

Swing Traders looking for a New Trading Strategy

Japanese Candlestick Traders who want to further master these Powerful Trading Tools

Traders who no longer want to be Handcuffed to their Computers Every Day

Traders patiently focused on their Long-Term Success from this Market

New Traders who want both the Foundation and Advanced Level Knowledge to Understand this Challenging Market

New and Experienced Traders who want to Demo Trade to practice hitting Large Trading Targets before going/returning to Live Trading

Traders who accurately predict Market Direction but cannot decide on the right Pip Targets

Traders who are annoyed at being Stopped Out too early only to see the market continue to their Initial Targets!

Traders who want to avoid the temptation of interfering with their Profitable Trades – that would have closed on their own at a Larger Profit had they not interfered! Yes I’m talking about you!

Traders who want Real Trading Knowledge beyond the Recycled Information readily available to all

Traders who know that there must be a Method to this “ Madness”

Traders who are tired of Learning and Learning and more Learning and want to finally Dominate the Art of Foreign Currency Trading

________________________________

GET STARTED ON YOUR JOURNEY TOWARDS TRADING SUCCESS TODAY

________________________________

Standard Service includes the Trading Manual, Daily Video Lessons, Trading Signals & Daily Trade Support.

VIP Service includes the Standard Package & VIP Mentoring.

Both Services Renewable at 80% of Subscription Rate.

_________________________________

Trading Manual Sent in PDF Format.

Video Lessons Sent at 6PM EST Monday to Friday.

Trading Signals Sent 1 Hour Before Each Trade.

VIP Skype Sessions are 30 Minutes Daily.

________________________________

________________________________

Email me for your Subscription Invoice.

All Payment Types Processed by PayPal.

|

Your Mentor

Duane Shepherd

(M.Sc. Economics, B.Sc. Management and Economics)

Currency Analyst/Trader

shepherdduane@gmail.com /(876)-3825648

Twitter: @WorldWide876

Facebook: DRFXTRADING

Website : Coming Soon - April 10th, 2018

Website : Coming Soon - April 10th, 2018

________________________________

RISK DISCLOSURE

All the information provided in this blog and as part of my Services, including the Trading Manual, Video Lessons, Daily Trade Support and Skype Mentoring represent my opinions on the relationship between Japanese Candlestick Patterns on the Daily & 4 Hour Charts and Exchange Rate Movements.

Although I use this information to execute trades in the Forex Market using my personal funds via a Live Forex Account, the Trading Signals I provide represent what I am about to do on a Demo Account that I also have at FXCM where no money is used and therefore where no investment can take place.

I do not provide Investment Advice and therefore my Trading Signals and my opinions about the Forex are intented to be executed on Demo Accounts.

Essentially, I am a Live Account Forex Trader who teaches you how to trade on a Demo Account. You can then use your performance on your Demo Account to enter Demo Account Trading Contests to win prize money, apply for Trading Jobs or use it when consulting with a Licensed Investment Advisor to decide if trading on a Live Forex Account is appropriate for you.

TRADING IS NOT FOR EVERYONE. TRADING FOREX INVOLVES HIGH RISKS AND THE POTENTIAL TO LOSE ALL OF YOUR TRADING CAPITAL

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to use my material on a Live Account, you should speak to a Licensed Investment Advisor, carefully consider your investment objectives, level of experience and risk appetite. You can lose all of your invested capital.

There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair.

Market Opinions

TRADING IS NOT FOR EVERYONE. TRADING FOREX INVOLVES HIGH RISKS AND THE POTENTIAL TO LOSE ALL OF YOUR TRADING CAPITAL

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to use my material on a Live Account, you should speak to a Licensed Investment Advisor, carefully consider your investment objectives, level of experience and risk appetite. You can lose all of your invested capital.

There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair.

Market Opinions

The content provided by drfxtrading.blogspot.com is for educational purposes only.

No information presented constitutes a recommendation by drfxtrading.blogspot.com to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy.

Any opinions, news, research, analyses, prices, or other information contained on this blog are provided as my opinion of how Exchange Rates move in accordance with Japanese Candlestick Patterns and do not constitute investment advice.

Drfxtrading.blogspot.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information on a Live Forex Account.

YOU are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs.

You should NOT rely solely upon the information or opinions that you read on the blog or receive via my Services. Rather, you should use what you read and receive as a starting point for doing your own independent research, your own independent analysis, and refine your own trading methods before placing your money at risk.

Internet Trading Risks

There are risks associated with utilizing an Internet-based deal execution trading system including, but not limited to, the failure of hardware, software, and Internet connection. Since drfxtrading.blogspot.com does not control signal power, its reception or routing via Internet, configuration of your equipment or reliability of its connection, I cannot be responsible for communication failures, distortions or delays when trading via the Internet.

Accuracy of Information

The content on this website is subject to change at any time without notice and is provided for the sole purpose of assisting traders to make independent investment decisions.

drfxtrading.blogspot.com has taken reasonable measures to ensure the accuracy of the information on the blog.

However, drfxtrading.blogspot.com does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the blog, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this website.

Distribution

This blog is not intented for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation.

None of the Services offered are to be used by persons from a country where the provision of such services would be contrary to local law or regulation.

It is the responsibility of visitors to this blog and users of my Services to ascertain the terms of and comply with any local law or regulation to which they are subject.

____________________________

Distribution

This blog is not intented for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation.

None of the Services offered are to be used by persons from a country where the provision of such services would be contrary to local law or regulation.

It is the responsibility of visitors to this blog and users of my Services to ascertain the terms of and comply with any local law or regulation to which they are subject.

____________________________

Comments

Post a Comment