A 28% MONTHLY RETURN THAT CAN PUT YOU IN CHARGE OF YOUR TRADING SUCCESS

This Rate of Return was earned during the Trading Competition with Dukascopy Bank for the month of December, 2017. Although it was not enough to win the competition or even place in the top 10, it is more than enough to be successful with a Live Account and reflected the Monthly Targets I have set for my Account.

With my new Aggressive Swing Trading Strategy that patiently targets High Probability Trades with Candlestick Signals on the Daily & 4 Hour Charts, only a few trades are needed to capture this type of Return that can provide you with significant gains in a very short time.

With my new Aggressive Swing Trading Strategy that patiently targets High Probability Trades with Candlestick Signals on the Daily & 4 Hour Charts, only a few trades are needed to capture this type of Return that can provide you with significant gains in a very short time.

VIDEO ANALYSIS OF TRADING PERFORMANCE

____________________________________________________

The table below shows the summary of the monthly outcome in the competition. For the period, a 28% Rate of Return was earned with a Maximum Drawdown of just 5%.

SUMMARY OF PERFORMANCE

This Return was in sync with monthly target that I have set for my personal trading on my Live Account...

MONTHLY TRADING TARGETS

Once a Retail Trader is able to earn this type of Return each month, significant gains can be achieved from this Trillion Dollar Market in just a few months...

___________________________________________________

The Aggressive Swing Trading Strategy I use is summarized below. Powerful and accurate Candlestick Signals and Consolidation Setups are used to Swing Trade the Daily and 4 Hour Charts each week. This is based on the Trading Theories and Strategies that are explained in detail in my comprehensive 219-Page Trading Manual.

THE SWING TRADING METHODOLOGY

As you heard in the video above, there are times when trades that offer less than 50 Pips or more than 70 Pips are also targeted, so long as the setup is strong enough to justify taking the risk. All trades are held for a maximum of 24 Hours since this was discovered to be the time needed for the High Probability Trades to hit their Pip Targets. It also imposes a level of discipline that prevents us from being greedy.

MONTHLY STATISTICS

As you can see from the table above, the performance in the competition reflected the main aspects and goals of my Methodology...

1. Only a Few Trades Needed for Strong Returns

2. Fast Turnover/Overnight Results

3. Average Drawdowns of just 3.96%

4. No Need to Target Thousand of Pips Each Month

5. No Need to Trade this Market Everday

1. Only a Few Trades Needed for Strong Returns

2. Fast Turnover/Overnight Results

3. Average Drawdowns of just 3.96%

4. No Need to Target Thousand of Pips Each Month

5. No Need to Trade this Market Everday

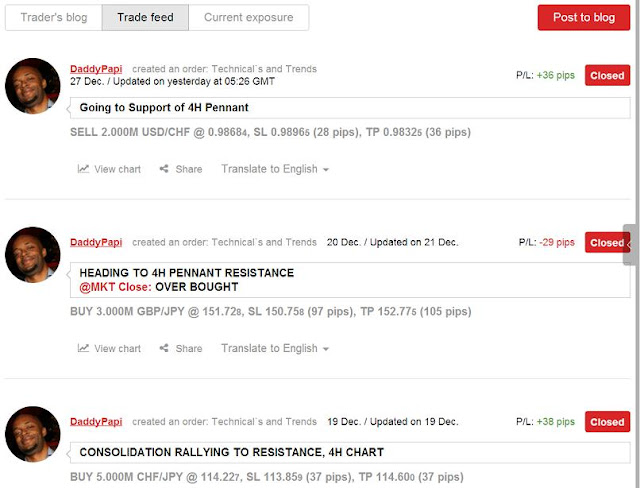

SUMMARY OF TRADES

USD CHF 4H CHART - 32 PIPS

- This Pair was forming a Pennant Consolidation Setup;

- The Support Boundary & 1 Resistance Point had already been formed;

- The 2nd Resistance Point to complete the Resistance Boundary and the overall Pennant was being formed by the Bearish Signal & Trend Line Break;

- Entry took place at the Signal with the Target Set for Support;

- After Just 12 Hours, the Target was Hit.

VIDEO ANALYSIS OF TRADE

CHF JPY 4H CHART - 37 PIPS

- This Pair had already formed a Range Consolidation Setup;

- The Pair had recently U-Turned at Support and was headed to Resistance;

- A Sharp Rally was taking place with Bullish Candles;

- Entry took place at one of these Bullish Candle Signals;

- The Stop Loss was placed below the Candle;

- Target was set to the Resistance Boundary which was hit within 24 Hours.

VIDEO ANALYSIS OF TRADE

GBP AUD 4H CHART - 109 PIPS

- This Pair was forming a Pennant Consolidation Setup;

- 1 Support & Resistance Point had already been formed;

- The 2nd Resistance Point to complete the Resistance Boundary was being formed by the Bearish Trend that had started;

- Entry took place at a Bearish Signal with the Target Set to where the Support Boundary was expected to be formed;

- After Just 24 Hours, the Target was Hit.

VIDEO ANALYSIS OF TRADE

EURO NZD 4H CHART - 74 PIPS

- This Pair had already formed a Range Consolidation Setup;

- A Failed Bullish Breakout took place above Resistance to then U-Turn back inside of the Range;

- False Breakouts usually head back inside of the Consolidation and then break at the other boundary;

- Entry took place at one of the Bearish Signals with the Target Set for Support and the Stop Loss placed above the Downtrend Line;

- Within 24 Hours, the Target was Hit.

VIDEO ANALYSIS OF TRADE

As you can see from these videos, all of these trades were based on Consolidation Setups that were either in the process of being formed or were already formed. This means the knowledge of the Signals and Patterns that control these setups is essential to taking advantage of them each week.

IDENTIFYING CONSOLIDATION SETUPS

The first step is knowing how to identify these setups. There are certain patterns that tell us when the market is forming these setups, as described in detail in the Trading Manual as well as how to accurately draw them ..

However, this is easier said than done because of the many challenges involved in drawing and trading them such as...

- Should you draw the Support & Resistance Lines across the Body or the Wicks of the Candles? or Both?

- Which Consolidations are too risky to trade?

- Which Candlestick Signals are reliable vs risky ones that lead to losses?

- Which Breakout Candlestick Signals are risky and usually lead to False Breakout Reversals back inside of the Consolidation?

- Should you always trade to the Resistance/Support Boundary or exit just ahead of these areas?

- Where are the safest Stop Loss Areas and does it depend on the type of Trends/Candles within the Consolidation?

These are just a handful of the issues that we face when trying to master these popular setups that appear each week. If you have the solutions to these questions (provided to you in my Trading/Mentorship Service) and include them as part of your trading, consistent gains from them can be yours.

BENEFITS OF THE SWING TRADING METHODOLOGY & TRADING SERVICE

1. SHORT HOLDING PERIODS

As you saw above, these trades only took an average of 16.5 hours to hit their targets, well within the 24 Hour Limit and similar to this AUD CAD trade on my Live Account that took just 12 hours..

This is one of the main benefits of the new strategy especially if you do not have time to monitor the market- the ability to trade setups that take a very short time to hit their targets.

2. LARGER RATES OF RETURN

On average, these trades provide Risk-Rewards of 1,5 - 2,0, offering a wide Profit Margin. This means that if you Risk between 2% and 4% of your Capital per Trade, only a few trades are needed each month to capture attractive Rates of Returns.

3. CLEANER CHARTS, EASIER TRADE DECISIONS

As you can see from the graphs above, the strategy is based on Candlestick Candles and Signals, together with Consolidation and Trend Lines to identify setups. This makes trade decisions a lot easier compared to Statistical Indicators that clutter your charts or Economic Analysis of volatile data...

4. RELIABLE HIGHER TIME FRAMES

When you combine these benefits with the reliability and stability of the Daily and 4 Hour Chart Signals, you can really enjoy Swing Trading this wonderful market that can provide you with significant Long-Term Profitability...

________________________________

Forecasting Accuracy you can enjoy Every Week by Subscribing to my World Class Mentoring Service.

________________________________

THE TRADING STRATEGY & MENTORING SERVICE

The Graph below illustrates the Aggressive 24 Hour Strategy that I use on my Live Account which takes advantage of the ability to accurately forecast the Weekly Range of Exchange Rate Movements of Currency Pairs using the Larger Time Frames.

There are times when trades that offer less than 50 Pips or more than 70 Pips are also targeted, so long as the setup is strong enough to justify taking the risk. All trades are held for a maximum of 24 Hours since this was discovered to be the time needed for the High Probability Trades to hit their Pip Targets. It also imposes a level of discipline that prevents us from being greedy.

Rate of Return Targets

The new Trading Strategy builds on the previous strategy that targeted 100 to 200 Pips over 7 Days and which provided Annual Returns of 40% on average - a performance which beat that of most of the Top 10 Currency Traders as ranked by BarclayHedge.

RATE OF RETURN 2015

RATE OF RETURN 2016

However, despite this strong performance, the limited range of price movement that has now affected most currencies has led to the need to target smaller Pip Ranges each week. With a greater number of these setups availabke to be captured each month, larger and faster Rates of Returns can now be realized.

Creation and Testing of Strategy

To ensure that this new strategy could be sustainable over the long-term, all of 2017 was dedicated to creating and testing a strategy that would have a robust set of parameters and trading rules. This would ensure it could stand up to the strict statistical analysis by Myfxbook

and meet the following criteria for a Real World Trading Strategy;

2. DOES NOT REQUIRE ECONOMIC ANALYSIS

3. DOES NOT REQUIRE MONITORING OF THE TRADE

4. REQUIRES ONLY A HANDFUL OF QUALITY TRADES

5. KEEPS YOUR CHARTS CLEAN & INDICATOR-FREE

6. OFFERS STRONG MONTHLY RETURNS OVER THE LONG-RUN

Having completed this period of extensive research and backtesting to meet these goals, conformation of the viability of the strategy came when it provided a 28% Rate of Return in the December Trader Contest with Dukascopy Bank - in line with the new monthly targets of the strategy.

SUMMARY OF PERFORMANCE

(Check out this blog post for more details of this contest performance that was aimed at testing the strategy - not winning the competition. https://drfxtrading.blogspot.com/2017/12/28-monthly-return-can-put-you-in-charge.html?q=A+28&m=1)

This now sets the stage for what can be expected of my Tracked & Verified Live Account over the next 6 Months starting in February.

CURRENT RETURN - FEBRUARY 2017

Risk Capital Per Trade

For conservative traders who apply a Risk of up to 2% Per Trade to my Trading Signals, the strategy aims to provide a Return of up to 14% Per Month. For the aggressive Retail Traders who use up to 4% Per Trade, gains of up to 30% can be realized...

CONSERVATIVE TRADING TARGETS

|

| (Assumes average number of trades of 7 per month.) |

Once the aggressive Retail Trader is able to earn this type of Return each month, even larger trading gains can be achieved from this Trillion Dollar Market in just a few months.

The Main Tools of the Swing Trading Strategy

The Trading Strategy uses accurate Candlestick Patterns, Trend Lines and Consolidation Setups of the Daily and 4 Hour Charts to Accurately Forecast Market Direction and target High Probability Setups each week. Stop Losses of 40 Pips on average are used for each trade, using the strongest areas on the 4 Hour Chart to protect the trade.

After experimenting with various Statistical Indicators across all time frames for several years, I finally discovered that there were certain combinations of Japanese Candlestick Patterns that offered more reliable Entry Signals, especially when combined with the correct way of drawing Trend Lines and the "Best-Fit" Method of identifying Consolidation Setups. When this is done within the framework of strict Trading Rules and Guidelines from the Trading Manual, larger returns are possible for us Retail Traders each month.

Stop Loss Placement

To protect the trade over the 24 Hour Holding Period against temporary pull backs, the following areas on the 4 Hour Chart are used for our Stop Losses

- Strong Trend Lines

- The Support/Resistance of Consolidations

- The Low/High of Candlestick Formations

These are the only areas deemed strong enough to protect trades until the trade targets are hit. If these are not present on the 4H, the trade will be deemed too risky and will be foregone to avoid losses.

The Holding Period & Trade Exit Rules

What I discovered was that in 90% of the scenarios in which the High Probability Setups offered stable 50-70 Pip moves, they didnt need more than 24 Hours on average to hit these targets. Any longer than this usually meant that the market was beginning to slow down and that a reversal was imminent. This is why as one of the rules of my strategies, any trade that has not hit its target within this fixed period will always be closed. This is done to avoid the bad habit of becoming greedy or needy and more importantly to avoid severe trade losses from sharp reversals.

Trading Frequency

On average, there are 1 to 2 of these High Probability Setups that arise each week. This means that with an average time of 3 to 7 days between trades, you will not have to be tied to your computer screen everyday and will have time to recover from both the euphoria of a good trade as well as the disappointment of a loss. This ensures that you can remain objective for your next trade without being overconfident or wanting to exact revenge on the market that took away our money.

Market Setups Traded

Due to the narrow range of currency movements that we see each month, more Consolidation Setups have been formed across Currency Pairs with very few of them providing stable and reliable breakout opportunities as they had in the past. This is why my trading is done strictly within the Consolidation Setups formed on the Daily and 4 Hour Charts.

Consolidations that have a minimum distance of 150 Pips and a maximum of 400 Pips between Support and Resistance are the ones that are traded. These allow us to comfortably capture our trading targets within these wide ranges, while not having to wait too long for these gains to be realized.

Consolidations that have a minimum distance of 150 Pips and a maximum of 400 Pips between Support and Resistance are the ones that are traded. These allow us to comfortably capture our trading targets within these wide ranges, while not having to wait too long for these gains to be realized.

Higher vs Lower Time Frames

Higher Time Frames in general were found to be more reliable with fewer False Signals and "Whiplashes" compared to the 1 Hour and lower charts. With this in mind, the Daily and 4 Hour Charts were then chosen as the time frames to use because they offer the best combination of the following factors that we all look for in a profitable strategy

- Reliable Signals & Stable Patterns

- Strong & Reliable Stop Loss Areas

- Manageable Stop Loss sizes

- Setups with a High Probability of Success

-Trading Targets with Small Holding Periods

Trading Platforms

The Strategy uses the Candlestick Patterns and Signals from FXCM platforms which uses the New York Close of the Daily Candlestick Signal - crucial to trading strategies such as mine.

THE FXCM TRADING PLATFORM

|

| Although other Platforms use the New York Close Candle, for some reason the FXCM platform seems to provide the most reliable version of the Candle. |

Once the FXCM Signals are provided by the Daily and 4 Hour Charts, the Entry Price, Stop Loss and Limit Order are then executed on my Live FXPRO Account...

LIVE ACCOUNT FXPRO PLATFORM

So each Trading Signal you receive will be based on the FXCM Charts and the result of each trade will be shown both privately to DRFX Subscribers and here on my blog using the FXCM Charts and my Live Account Charts.

Trading Signals

Once a profitable Swing Trading opportunity is identified, you will be sent the FXCM Chart showing the overall setup and expected market direction.

4 HOUR CHART

You will also be provided with the explanation and theories behind the trade using the relevant section of the Manual. This trade was based on the theory of Consolidations from the Trading Manual, which shows us how to spot and trade the formation of Consolidations...

PAGE 119 OF TRADING MANUAL

The Chart Analysis Sheet in the Manual that is used to ensure that the trade meets all the relevant criteria will also be given to you.

CHART ANALYSIS SHEET

Once it is determined that the trade can be taken, the Trade Entry Sheet with the necessary instructions and price information is filled out and sent for you to execute the trade on your preferred platform.

TRADE ENTRY SHEET

TRADE RESULT

Economic & Financial News

As a former Central Bank Economist with a Masters in Economics, I can state categorically that a knowledge of Economics or Financial Markets is NOT necessary to successfully trade the Forex Market.

Yes it is true that many strategies out there successfully use Economic Data to predict market direction and that knowledge of various Economic Variables is crucial to the conduct of Monetary and Exchange Rate Policies. However, at the Retail Trader level that targets short moves within 24 hours, finding accurate Candlestick Signals was found to be more reliable than using short -term economic data that is too volatile to be used in a meaningful way.

In addition, what you will notice is that whenever there is a major news release during the day, the Candlestick Signal formed on the Larger Charts will eventually reflect the overall reaction by the market to the news. This means that you can simply wait for this Candle to close to indicate where the market is headed and then trade accordingly - without having to play the guessing game with these releases on the smaller charts. The trading gain on the NZD CHF just ahead of the Swiss National Bank Shocker of January 2015 was the best example of Candlestick Patterns providing profitable trades and identifying exit points ahead of market reversals even in the context of extreme financial turmoil (see "New Year off to a Flying Start - 231 Pips and 194 Pips on NZD CHF Trade" in the archives of this blog- Januay 8th, 2015).

________________________________

Happy Trading

Your Mentor

Duane

DRFXTRADING

________________________________

WHAT MAKES MY SERVICES DIFFERENT FROM THE REST?

These are Strong and Realistic Targets that will keep you Focused and Motivated.

The Previous Conservative Strategy targeted 100 to 200 Pips of these movements per trade each month. This provided average annual returns of 40% in 2015 and 2016.

Despite these great results, a more aggressive strategy is now being used beginning February 1st, 2018.

________________________________

1. YOU WILL HAVE SPECIFIC RATE OF RETURN TRADING TARGETS

________________________________

|

| Assumes an Average Risk of 3% Per Trade, trading just a few times per month. You may use the Risk Per Trade you prefer when applying my Trading Signals. |

These are Strong and Realistic Targets that will keep you Focused and Motivated.

________________________________

2. YOU WILL EXPERIENCE TRADING ACCURACY BEYOND THE COMPETITION

________________________________

NZD CHF CONSOLIDATION BREAKOUT IN JANUARY 2015

ACCURATE EXIT AHEAD OF THE SWISS NATIONAL BANK "SHOCKER" - JUST A FEW DAYS LATER

|

| (See full description of this trade here New Year off to a Flying Start - 231 Pips & 194 Pips on NZD CHF Trade & more Financial Crisis trade results here 200 Pip Targets Still Hit During Financial Crisis ) |

Candlestick Patterns accurately identify the best Trading Targets ahead of both Normal and Abnormal Market Reversals.

________________________________

3. YOU WILL TAKE ADVANTAGE OF STRESS-FREE, INDICATOR-FREE SWING TRADING

________________________________

Instead of using Complicated Statistical Indicators or volatile Economic Data, the more reliable Japanese Candlestick Signals of the Daily and 4 Hour Charts are used to predict and trade the Weekly Direction of Currency Pairs.

________________________________

4. YOU WILL ENJOY TRADING WITH AN AGGRESSIVE 24-HOUR STRATEGY

_______________________________

Despite these great results, a more aggressive strategy is now being used beginning February 1st, 2018.

________________________________

5. YOU WILL LEARN ABOUT THE WEEKLY RANGES OF CURRENCY PAIRS

________________________________

The First Step in Swing Trading the Forex with me is to accurately predict the Weekly Range Direction of the major Currency Pairs.

All Currency Pairs have Weekly Ranges which is their average Exchange Rate Price Movements expressed in Pips over 5 to 7 Days. Trading is then done in this direction to capture our Pip Targets according to our Swing Trading Strategy.

________________________________

6. YOU WILL LEARN ABOUT TRENDS & THE PATTERNS THAT LEAD TO TREND CHANGES

________________________________

7. YOU WILL LEARN HOW TO IDENTIFY CONSOLIDATION BOUNDARIES

________________________________

There are many schools of thought on how to draw Consolidation Support and Resistance Lines. However, the "Line of Best Fit" method is the only way to do this accurately.

________________________________

8. YOU WILL LEARN HOW TO PREDICT & TRADE FALSE CONSOLIDATION BREAKOUTS

________________________________

Instead of losing due to unexpected Consolidation Market Reversals, we can master and profit from them once we understand their Structure and the Candlestick Signals that start them.

________________________________

9. YOU WILL LEARN HOW TO PREDICT THE FORMATION OF CONSOLIDATIONS

________________________________

10. YOU WILL LEARN TRADING TECHNIQUES THAT HAVE WON CONTEST PRIZES

________________________________

________________________________

11. YOU WILL HAVE A MENTOR WITH A LIVE FOREX ACCOUNT

________________________________

At 7.3% from just 2 trades in February 2018, only a few trades are left to hit the first target of 14% before moving on to the next major targets.

________________________________

12. YOU WILL ENJOY THE BENEFITS OF A PATIENT APPROACH TO TRADING SUCCESS

________________________________

________________________________

________________________________

ONE OF THE FREE VIDEO LESSONS AVAILABLE ON MY YOUTUBE CHANNEL & IN TRADING BLOGS

________________________________

________________________________

WHO WILL BENEFIT THE MOST FROM THIS MENTORING SERVICE?

________________________________

Day Traders Looking to Switch to the Stability of the Higher Time Frames

Swing Traders looking for a New Trading Strategy

Japanese Candlestick Traders who want to further master these Powerful Trading Tools

Traders who no longer want to be Handcuffed to their Computers Every Day

Traders patiently focused on their Long-Term Success from this Market

New Traders who want both the Foundation and Advanced Level Knowledge to Understand this Challenging Market

New and Experienced Traders who want to Demo Trade to practice hitting Large Trading Targets before going/returning to Live Trading

Traders who accurately predict Market Direction but cannot decide on the right Pip Targets

Traders who are annoyed at being Stopped Out too early only to see the market continue to their Initial Targets!

Traders who want to avoid the temptation of interfering with their Profitable Trades – that would have closed on their own at a Larger Profit had they not interfered! Yes I’m talking about you!

Traders who want Real Trading Knowledge beyond the Recycled Information readily available to all

Traders who know that there must be a Method to this “ Madness”

Traders who are tired of Learning and Learning and more Learning and want to finally Dominate the Art of Foreign Currency Trading

________________________________

GET STARTED ON YOUR JOURNEY TOWARDS TRADING SUCCESS TODAY

________________________________

THE 3-MONTH SERVICES

Standard Service includes the Trading Manual, Daily Video Lessons, Trading Signals & Daily Trade Support.

VIP Service includes the Standard Package & VIP Mentoring.

________________________________

________________________________

Contact Me for Your Subscription Service Invoice Today!

All Payment Types Processed by PayPal.

Your Mentor

Duane Shepherd

(M.Sc. Economics, B.Sc. Management and Economics)

Currency Analyst/Trader

shepherdduane@gmail.com /(876)-3825648

Twitter: @WorldWide876

Facebook: DRFXTRADING

________________________________

RISK DISCLOSURE

All the information provided in this blog and as part of my Services, including the Trading Manual, Video Lessons, Daily Trade Support and Skype Mentoring represent my opinions on the relationship between Japanese Candlestick Patterns on the Daily & 4 Hour Charts and Exchange Rate Movements.

Although I use this information to execute trades in the Forex Market using my personal funds via a Live Forex Account, the Trading Signals I provide represent what I am about to do on a Demo Account that I also have at FXCM where no money is used and therefore where no investment can take place.

I do not provide Investment Advice and therefore my Trading Signals and my opinions about the Forex are intented to be executed on Demo Accounts.

Essentially, I am a Live Account Forex Trader who teaches you how to trade on a Demo Account. You can then use your performance on your Demo Account to enter Demo Account Trading Contests to win prize money, apply for Trading Jobs or use it when consulting with a Licensed Investment Advisor to decide if trading on a Live Forex Account is appropriate for you.

TRADING IS NOT FOR EVERYONE. TRADING FOREX INVOLVES HIGH RISKS AND THE POTENTIAL TO LOSE ALL OF YOUR TRADING CAPITAL

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to use my material on a Live Account, you should speak to a Licensed Investment Advisor, carefully consider your investment objectives, level of experience and risk appetite. You can lose all of your invested capital.

There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair.

Market Opinions

TRADING IS NOT FOR EVERYONE. TRADING FOREX INVOLVES HIGH RISKS AND THE POTENTIAL TO LOSE ALL OF YOUR TRADING CAPITAL

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to use my material on a Live Account, you should speak to a Licensed Investment Advisor, carefully consider your investment objectives, level of experience and risk appetite. You can lose all of your invested capital.

There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair.

Market Opinions

The content provided by drfxtrading.blogspot.com is for educational purposes only.

No information presented constitutes a recommendation by drfxtrading.blogspot.com to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy.

Any opinions, news, research, analyses, prices, or other information contained on this blog are provided as my opinion of how Exchange Rates move in accordance with Japanese Candlestick Patterns and do not constitute investment advice.

Drfxtrading.blogspot.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information on a Live Forex Account.

YOU are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs.

You should NOT rely solely upon the information or opinions that you read on the blog or receive via my Services. Rather, you should use what you read and receive as a starting point for doing your own independent research, your own independent analysis, and refine your own trading methods before placing your money at risk.

Internet Trading Risks

There are risks associated with utilizing an Internet-based deal execution trading system including, but not limited to, the failure of hardware, software, and Internet connection. Since drfxtrading.blogspot.com does not control signal power, its reception or routing via Internet, configuration of your equipment or reliability of its connection, I cannot be responsible for communication failures, distortions or delays when trading via the Internet.

Accuracy of Information

The content on this website is subject to change at any time without notice and is provided for the sole purpose of assisting traders to make independent investment decisions.

drfxtrading.blogspot.com has taken reasonable measures to ensure the accuracy of the information on the blog.

However, drfxtrading.blogspot.com does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the blog, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this website.

Distribution

This blog is not intented for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation.

None of the Services offered are to be used by persons from a country where the provision of such services would be contrary to local law or regulation.

It is the responsibility of visitors to this blog and users of my Services to ascertain the terms of and comply with any local law or regulation to which they are subject.

__________________________________

Distribution

This blog is not intented for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation.

None of the Services offered are to be used by persons from a country where the provision of such services would be contrary to local law or regulation.

It is the responsibility of visitors to this blog and users of my Services to ascertain the terms of and comply with any local law or regulation to which they are subject.

__________________________________

Comments

Post a Comment