88 PIIPS FROM FALSE BREAKOUT REVERSAL

The EURO AUD Pair provided a strong Bearish Signal to indicate the reversal back inside of the Daily Chart Range Setup. This appeared following 2 failed attempts to get things going Bullish above Resistance. Based on the theory of False Consolidation Breakouts from my Trading Manual, the expectation was for a profitable reversal from this reversal....

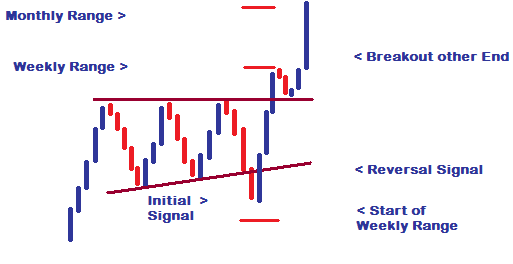

The Chart below shows the Signal given on the Daily Chart at Resistance to start the movement back to Support.

DAILY CHART

This meant that traders needed to find a way to trade this expected decline quickly, before the opportunity is missed. Looking at the 4 Hour Chart-which is my choice for entry - an Entry Setup came in the form of a breakout from Consolidation.

4 HOUR CHART

Instead of using the Resistance, the Stop Loss place above the Trend Line which was strong enough to protect the trade. The target was set to just above the Support. After entering the trade and leaving it open for 2 Days (Maximum Holding Period for this type of trade), the trade was closed for a gain of 88 Pips.

4 HOUR CHART

DAILY CHART

This trade confirmed the forecast given for this strong reversal. These types of trades can be extremely profitable once spotted, providing profitable trades in a very short period of time.

Once we are able to spot these setups and trade with the right strategy and guidelines, consistent gains from these movements can be captured each week.

BECOME A DRFX SUBSCRIBER TODAY

_______________________________

Sounds Good?

_______________________________

Contact Me for your Free 10-Day Trial or for your Subscription Service Invoice Today!

All Payment Types Processed by PayPal.

Bank Transfer Also Available.

Your Mentor

Duane Shepherd

(M.Sc. Economics, B.Sc. Management and Economics)

Currency Analyst/Trader

shepherdduane@gmail.com /(876)-3825648

Twitter: @WorldWide876

Facebook: DRFXTRADING

________________________________

________________________________

Comments

Post a Comment