130 PIPS - GBP USD PROVIDES US WITH ANOTHER TRADING GAIN

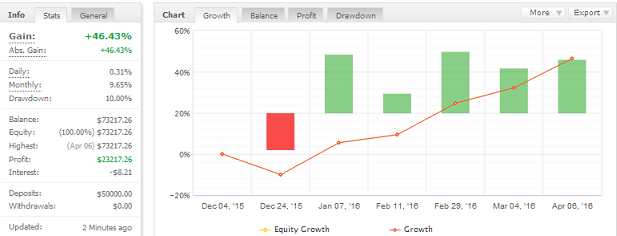

This popular currency pair provided us with another strong gain of 130 Pips within 3 days at the start of April. The pair had been moving within a Range Setup on the Daily Chart and had given a Bearish Signal at Resistance to indicate the start of a move back to Support. After analyzing the trade and ensuring that it met my trading rules, the trade was executed on the 4 Hour Chart. Despite a sharp rally that threatened the Stop Loss, the market eventually U-Turned to head towards Support, providing us with the trading gain. With this trade, the 2016 Rate of Return for Subscribers to my Trading Signals is now 46% from just 6 trades. THE TRADE SETUP The Daily Chart below shows the Range Setup that was formed over the last few weeks as part of the major Downtrend in favour of the USD. After rallying to the Resistance, the pair began to U-Turn, giving a Morning Star Bearish Signal to indicate a move back to Support. DAILY CHART The...