149 PIPS EURO USD, 24,7% RATE OF RETURN

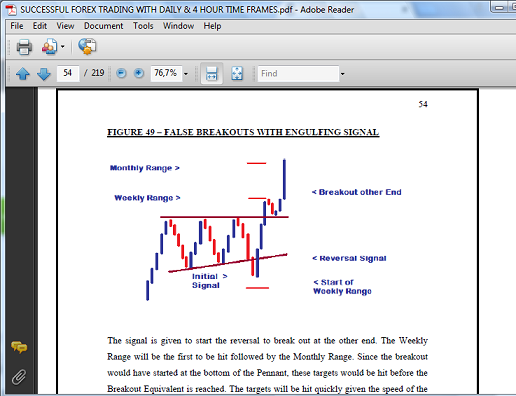

This trade took advantage of the movement back down to the Support Boundary of the Consolidation Setup on the Daily Chart, following the recent U-Turn at Resistance. Entry took place on the 4 Hour Chart following the Daily Bearish Candlestick Signal in the middle of the Consolidation. After a few days, target was hit for a gain of 149 Pips, pushing our Return to 24,7% from just 4 trades in 2 months. TRADE RESULT - EURO USD 149 PIPS RATE OF RETURN FOR 2016 (Click on Chart to go to System Page at Myfxbook) As you'll see in the Charts and the Video Analysis below, the Daily Chart started the downtrend with a strong U-Turn at Resistance. This was followed by another Bearish Candlestick Signal which we used for this trade. With the pair expected to hit the Support boundary, our target was set to an area just above this line, with entry taking place on the 4 Hour Chart. DAILY CHART SETUP DAILY CHART - ENTRY SIGNAL ...