GBP CHF REVERSES SHARPLY BEARISH AS PREDICTED

As I had pointed out in the analysis of the GBP CHF last week (see blog post archives), despite the Bullish Breakout Signal above the Penant of the Daily Chart, the current market conditions that have restricted major breakouts led to the appearance of a Sharp Bearish Reversal Signal. This initially cancelled out the Bullish Breakout Signal and was expected to take us back inside of the Pennant and back to Support...

DAILY CHART PENNANT PROJECTED REVERSAL

From the graph below, you can see that this Signal did in fact lead to the move back to Support as forecast, in sync with the theory of False Breakout Reversals from the Trading Manual...

DAILY CHART BEARISH REVERSAL AS PREDICTED

STRUCTURE OF FALSE BREAKOUT REVERSALS

|

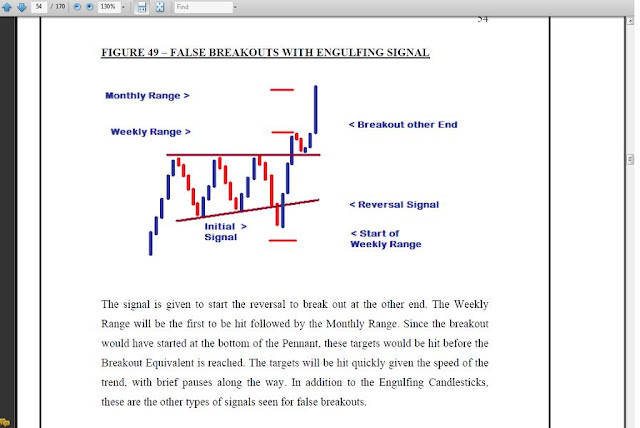

| In False Breakouts, the market reverses aggressively back inside of the Consolidation following a failed Breakout at the other end. |

Despite the fact that a strong Bullish Signal appeared above the Pennant to indicate the start of sharp gains for the GBP, major breakouts are becoming the exception rather the rule over the last 10 months. This means that even though Consolidation Breakouts still take place on the Smaller Charts, breakouts on the Larger Charts that would mean major currency price changes are no longer taking place.

Within this context, the best option is to always assume these setups will pullback inside of these Consolidations and look for trades in this direction, regardless of the strength of the initial Breakout Signals.

TRADE ENTRY SETUP & SIGNAL

Despite the accuracy of this forecast, the market did not provide me with a strong enough signal that justified trading this decline that offered up to 100 Pips in potential gains in a very short time.

This trade would have been a great example of how we trade the 4 Hour Chart after the Daily Chart gives us a signal. However, as you can sse from the chart below, the 4 Hour Signal had a very large wick compared to the size of the Body of the Candle itself- usually a sign of a very weak and risky signal to trade...

4 HOUR CHART ENTRY SIGNAL

|

| The Stop Loss would have been placed just above the Resistance High of the U-Turn. |

However, instead of the market rallying to take out this signal, the bearish reversal continued towards its target of the Support Boundary of this Pennant. So despite being spot on with the forecast for this market reversal, the weakness of the signal prevented me from taking full advantage of it.

This is something that happens from time to time in the Forex. Signals that are normally too risky to trade can sometimes still lead to profitable outcomes had we decided to trade them. Nevertheless, since this an exception to the general rule about signals to trade, we must never compromise our trading discipline by risking our capital on low probability signals and setups. We just need to simply move on and patiently wait for a better trade that meets the rules of the Trading Strategy and that offers a Higher Probability of Success.

EXAMPLES OF HIGH PROBABILITY CANDLESTICK SIGNALS FROM THE TRADING MANUAL

MAIN TECHNICAL FACTORS DISCUSSED

1. Reduced Trading Ranges in the Forex

2. Pennant Consolidation Setups

3. False Breakout Reversals and Signals

4. Weak vs Strong Candlestick Signals

5. Consolidation Breakout Signals

6. Market Conditions & Trading Strategies

THE TRADING STRATEGY & MENTORING SERVICE

The Graph below illustrates the Aggressive 24 Hour Strategy that I use on my Live Account which takes advantage of the ability to accurately forecast the Weekly Range of Exchange Rate Movements of Currency Pairs using the Larger Time Frames.

There are times when trades that offer less than 50 Pips or more than 70 Pips are also targeted, so long as the setup is strong enough to justify taking the risk. All trades are held for a maximum of 24 Hours since this was discovered to be the time needed for the High Probability Trades to hit their Pip Targets. It also imposes a level of discipline that prevents us from being greedy.

Rate of Return Targets

The new Trading Strategy builds on the previous strategy that targeted 100 to 200 Pips over 7 Days and which provided Annual Returns of 40% on average - a performance which beat that of most of the Top 10 Currency Traders as ranked by BarclayHedge.

RATE OF RETURN 2015

RATE OF RETURN 2016

However, despite this strong performance, the limited range of price movement that has now affected most currencies has led to the need to target smaller Pip Ranges each week. With a greater number of these setups availabke to be captured each month, larger and faster Rates of Returns can now be realized.

Creation and Testing of Strategy

To ensure that this new strategy could be sustainable over the long-term, all of 2017 was dedicated to creating and testing a strategy that would have a robust set of parameters and trading rules. This would ensure it could stand up to the strict statistical analysis by Myfxbook

and meet the following criteria for a Real World Trading Strategy;

2. DOES NOT REQUIRE ECONOMIC ANALYSIS

3. DOES NOT REQUIRE MONITORING OF THE TRADE

4. REQUIRES ONLY A HANDFUL OF QUALITY TRADES

5. KEEPS YOUR CHARTS CLEAN & INDICATOR-FREE

6. OFFERS STRONG MONTHLY RETURNS OVER THE LONG-RUN

Having completed this period of extensive research and backtesting to meet these goals, conformation of the viability of the strategy came when it provided a 28% Rate of Return in the December Trader Contest with Dukascopy Bank - in line with the new monthly targets of the strategy.

SUMMARY OF PERFORMANCE

(Check out this blog post for more details of this contest performance that was aimed at testing the strategy - not winning the competition. https://drfxtrading.blogspot.com/2017/12/28-monthly-return-can-put-you-in-charge.html?q=A+28&m=1)

This now sets the stage for what can be expected of my Tracked & Verified Live Account over the next 6 Months starting in February.

CURRENT RETURN - FEBRUARY 2017

Risk Capital Per Trade

For traders who apply a Risk of up to 4% Per Trade using my Trading Signals, gains of up to 30% Monthly can be realized..

MONTHLY TRADING TARGETS

________________________________

Happy Trading

Your Mentor

Duane

DRFXTRADING

________________________________

OR

________________________________

________________________________

CLEAR AND DEFINED LEARNING OUTCOMES

________________________________

________________________________

________________________________

1. YOU WILL EXPERIENCE TRADING ACCURACY BEYOND THE COMPETITION

________________________________

NZD CHF CONSOLIDATION BREAKOUT IN JANUARY 2015

ACCURATE EXIT AHEAD OF THE SWISS NATIONAL BANK "SHOCKER" - JUST A FEW DAYS LATER

|

| (See full description of this trade here New Year off to a Flying Start - 231 Pips & 194 Pips on NZD CHF Trade & more Financial Crisis trade results here 200 Pip Targets Still Hit During Financial Crisis ) |

Candlestick Patterns accurately identify the best Trading Targets ahead of both Normal and Abnormal Market Reversals.

________________________________

2. YOU WILL TAKE ADVANTAGE OF STRESS-FREE, INDICATOR-FREE SWING TRADING

________________________________

Instead of using Complicated Statistical Indicators or volatile Economic Data, the more reliable Japanese Candlestick Signals of the Daily and 4 Hour Charts are used to predict and trade the Weekly Direction of Currency Pairs.

________________________________

3. YOU WILL ENJOY TRADING WITH AN AGGRESSIVE 24-HOUR STRATEGY

_______________________________

Despite these great results, a more aggressive strategy is now being used beginning February 1st, 2018.

________________________________

4. YOU WILL LEARN ABOUT THE WEEKLY RANGES OF CURRENCY PAIRS

________________________________

The First Step in Swing Trading the Forex with me is to accurately predict the Weekly Range Direction of the major Currency Pairs.

All Currency Pairs have Weekly Ranges which is their average Exchange Rate Price Movements expressed in Pips over 5 to 7 Days. Trading is then done in this direction to capture our Pip Targets according to our Swing Trading Strategy.

________________________________

5. YOU WILL LEARN ABOUT TRENDS & THE PATTERNS THAT LEAD TO TREND CHANGES

________________________________

6. YOU WILL LEARN HOW TO IDENTIFY CONSOLIDATION BOUNDARIES

________________________________

There are many schools of thought on how to draw Consolidation Support and Resistance Lines. However, the "Line of Best Fit" method is the only way to do this accurately.

________________________________

7. YOU WILL LEARN HOW TO PREDICT & TRADE FALSE CONSOLIDATION BREAKOUTS

________________________________

Instead of losing due to unexpected Consolidation Market Reversals, we can master and profit from them once we understand their Structure and the Candlestick Signals that start them.

________________________________

8. YOU WILL LEARN HOW TO PREDICT THE FORMATION OF CONSOLIDATIONS

________________________________

9. YOU WILL LEARN TRADING TECHNIQUES THAT HAVE WON CONTEST PRIZES

________________________________

________________________________

10. YOU WILL HAVE A MENTOR WITH A TRACKED & VERIFIED LIVE FOREX ACCOUNT

________________________________

|

| Reflects the performance of the strategy since it began in February 2018. |

At 10.18% from just 4 trades since February 2018, only a few trades are left to hit the first target of 14% before moving on to the next major targets.

________________________________

THE COMPREHENSIVE TRADING & MENTORING SERVICE

________________________________

________________________________

EXAMPLE OF VIDEOS YOU WILL RECEIVE PRIVATELY EACH DAY

________________________________

________________________________

WHO WILL BENEFIT THE MOST FROM THIS MENTORING SERVICE?

________________________________

Day Traders Looking to Switch to the Stability of the Higher Time Frames

Swing Traders looking for a New Trading Strategy

Japanese Candlestick Traders who want to further master these Powerful Trading Tools

Traders who no longer want to be Handcuffed to their Computers Every Day

Traders patiently focused on their Long-Term Success from this Market

New Traders who want both the Foundation and Advanced Level Knowledge to Understand this Challenging Market

New and Experienced Traders who want to Demo Trade to practice hitting Large Trading Targets before going/returning to Live Trading

Traders who accurately predict Market Direction but cannot decide on the right Pip Targets

Traders who are annoyed at being Stopped Out too early only to see the market continue to their Initial Targets!

Traders who want to avoid the temptation of interfering with their Profitable Trades – that would have closed on their own at a Larger Profit had they not interfered! Yes I’m talking about you!

Traders who want Real Trading Knowledge beyond the Recycled Information readily available to all

Traders who know that there must be a Method to this “ Madness”

Traders who are tired of Learning and Learning and more Learning and want to finally Dominate the Art of Foreign Currency Trading

________________________________

GET STARTED ON YOUR JOURNEY TOWARDS TRADING SUCCESS TODAY

________________________________

Standard Service includes the Trading Manual, Daily Video Lessons, Trading Signals & Daily Trade Support.

VIP Service includes the Standard Package & VIP Mentoring.

Both Services Renewable at 80% of Subscription Rate.

_________________________________

Trading Manual Sent in PDF Format.

Video Lessons Sent at 6PM EST Monday to Friday.

Trading Signals Sent 1 Hour Before Each Trade.

VIP Skype Sessions are 30 Minutes Daily.

________________________________

________________________________

Email me for your Subscription Invoice.

All Payment Types Processed by PayPal.

|

Your Mentor

Duane Shepherd

(M.Sc. Economics, B.Sc. Management and Economics)

Currency Analyst/Trader

shepherdduane@gmail.com /(876)-3825648

Twitter: @WorldWide876

Facebook: DRFXTRADING

Website : Coming Soon - April 10th, 2018

Website : Coming Soon - April 10th, 2018

________________________________

RISK DISCLOSURE

All the information provided in this blog and as part of my Services, including the Trading Manual, Video Lessons, Daily Trade Support and Skype Mentoring represent my opinions on the relationship between Japanese Candlestick Patterns on the Daily & 4 Hour Charts and Exchange Rate Movements.

Although I use this information to execute trades in the Forex Market using my personal funds via a Live Forex Account, the Trading Signals I provide represent what I am about to do on a Demo Account that I also have at FXCM where no money is used and therefore where no investment can take place.

I do not provide Investment Advice and therefore my Trading Signals and my opinions about the Forex are intented to be executed on Demo Accounts.

Essentially, I am a Live Account Forex Trader who teaches you how to trade on a Demo Account. You can then use your performance on your Demo Account to enter Demo Account Trading Contests to win prize money, apply for Trading Jobs or use it when consulting with a Licensed Investment Advisor to decide if trading on a Live Forex Account is appropriate for you.

TRADING IS NOT FOR EVERYONE. TRADING FOREX INVOLVES HIGH RISKS AND THE POTENTIAL TO LOSE ALL OF YOUR TRADING CAPITAL

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to use my material on a Live Account, you should speak to a Licensed Investment Advisor, carefully consider your investment objectives, level of experience and risk appetite. You can lose all of your invested capital.

There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair.

Market Opinions

TRADING IS NOT FOR EVERYONE. TRADING FOREX INVOLVES HIGH RISKS AND THE POTENTIAL TO LOSE ALL OF YOUR TRADING CAPITAL

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to use my material on a Live Account, you should speak to a Licensed Investment Advisor, carefully consider your investment objectives, level of experience and risk appetite. You can lose all of your invested capital.

There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair.

Market Opinions

The content provided by drfxtrading.blogspot.com is for educational purposes only.

No information presented constitutes a recommendation by drfxtrading.blogspot.com to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy.

Any opinions, news, research, analyses, prices, or other information contained on this blog are provided as my opinion of how Exchange Rates move in accordance with Japanese Candlestick Patterns and do not constitute investment advice.

Drfxtrading.blogspot.com will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information on a Live Forex Account.

YOU are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs.

You should NOT rely solely upon the information or opinions that you read on the blog or receive via my Services. Rather, you should use what you read and receive as a starting point for doing your own independent research, your own independent analysis, and refine your own trading methods before placing your money at risk.

Internet Trading Risks

There are risks associated with utilizing an Internet-based deal execution trading system including, but not limited to, the failure of hardware, software, and Internet connection. Since drfxtrading.blogspot.com does not control signal power, its reception or routing via Internet, configuration of your equipment or reliability of its connection, I cannot be responsible for communication failures, distortions or delays when trading via the Internet.

Accuracy of Information

The content on this website is subject to change at any time without notice and is provided for the sole purpose of assisting traders to make independent investment decisions.

drfxtrading.blogspot.com has taken reasonable measures to ensure the accuracy of the information on the blog.

However, drfxtrading.blogspot.com does not guarantee its accuracy, and will not accept liability for any loss or damage which may arise directly or indirectly from the content or your inability to access the blog, for any delay in or failure of the transmission or the receipt of any instruction or notifications sent through this website.

Distribution

This blog is not intented for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation.

None of the Services offered are to be used by persons from a country where the provision of such services would be contrary to local law or regulation.

It is the responsibility of visitors to this blog and users of my Services to ascertain the terms of and comply with any local law or regulation to which they are subject.

____________________________

Distribution

This blog is not intented for distribution or use by any person in any country where such distribution or use would be contrary to local law or regulation.

None of the Services offered are to be used by persons from a country where the provision of such services would be contrary to local law or regulation.

It is the responsibility of visitors to this blog and users of my Services to ascertain the terms of and comply with any local law or regulation to which they are subject.

____________________________

Comments

Post a Comment