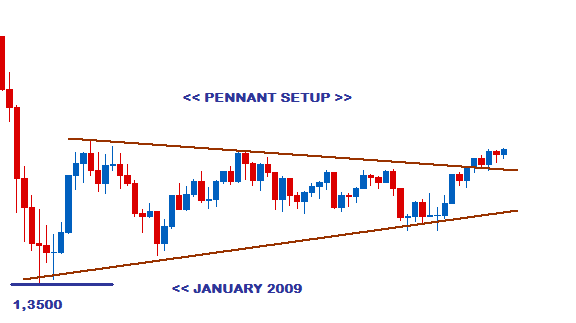

EURO AUD WEEKLY ANALYSIS

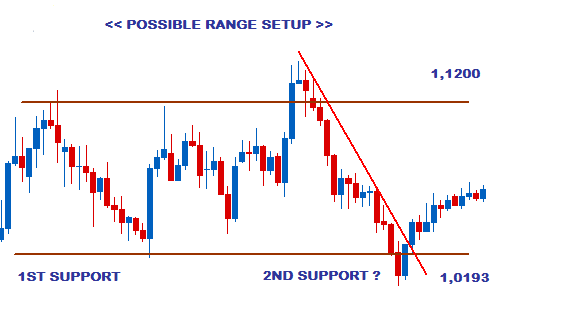

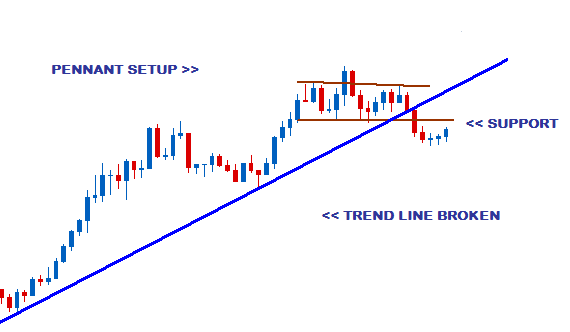

FALSE BREAKOUT OR PAUSE BEFORE SHARP DOWNTREND? False breakouts from consolidation setups are a common occurrence in the Forex market and can take various forms. In the case of the Euro Aud pair, we see that there has been a break of the Support of the Pennant formed just above its uptrend line suggests the start of a sharp downtrend. However, the sideways movement taking place below this area could also be the setup for a rally to go back inside of the Pennant to resume the uptrend. WEEKLY CHART In many cases, the Support area is tested by a temporary pullback before the breakout resumes from consolidation. This could be the scenario developing here on its way to several hundred pips of gains for the Australian Dollar. On the other hand, the strength of the uptrend suggests that a continued move in favour of the Euro is very likely and that a rally back above Support is expected. Based on the Daily Chart, this could already be