130 PIPS - GBP USD PROVIDES US WITH ANOTHER TRADING GAIN

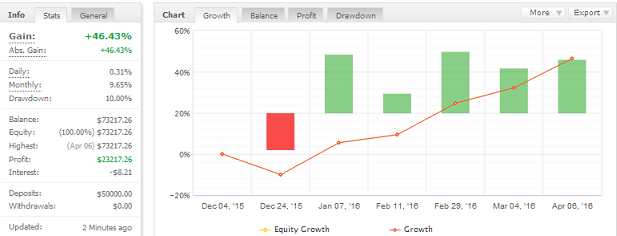

This popular currency pair provided us with another strong gain of 130 Pips within 3 days at the start of April. The pair had been moving within a Range Setup on the Daily Chart and had given a Bearish Signal at Resistance to indicate the start of a move back to Support. After analyzing the trade and ensuring that it met my trading rules, the trade was executed on the 4 Hour Chart. Despite a sharp rally that threatened the Stop Loss, the market eventually U-Turned to head towards Support, providing us with the trading gain. With this trade, the 2016 Rate of Return for Subscribers to my Trading Signals is now 46% from just 6 trades.

THE TRADE SETUP

The Daily Chart below shows the Range Setup that was formed over the last few weeks as part of the major Downtrend in favour of the USD. After rallying to the Resistance, the pair began to U-Turn, giving a Morning Star Bearish Signal to indicate a move back to Support.

DAILY CHART

The 4 Hour Chart was then analyzed together with the Daily Chart to determine if this setup met the requirements of the Methodology for trades within Consolidation. Once confirmed, the trade was executed on the 4 Hour Chart.

4 HOUR CHART ENTRY SETUP

The Downtrend Line was used for the Stop Loss to protect our trade with an Entry Order set to take us into the trade just below the Outer Uptrend Line. The Limit Order was set for the area just above Support and after 2 1/2 days, our target was hit.

DAILY CHART - SUCCESSFUL TRADE

One of the keys to these successful trades is the discipline to avoid monitoring the trade while it is open. It's very tempting to want to watch the market to "ensure" that our trade goes smoothly towards our target, but this action will eventually compromise your Long-Term Profitability.

You have to stay out the way of the natural dynamic of the market to wave, move sideways and reverse before heading to its target. Otherwise, you end up cutting trades before they have a chance of becoming profitable.

This trade provided a very good example of this issue. In the chart below, you can see that the market rallied sharply shortly after entry, coming very close to triggering the Stop Loss.

4 HOUR CHART - CLOSE CALL

There isn't one trader in the world who would not have wanted to exit the trade at the sight of this reversal. Yet, if this was done, we would have missed out on the large number of Pips offered as the market U-Turned to eventually head to Support.

SUMMARY

These types of setups are very common across the Currency Market. However, the key to taking advantage of them include using the right Methodology to identify and trade them correctly. This also has to be complemented by the patience to allow the market to head towards our targets without our intervention. Over the Long-Term, this discipline will reward you with consistent gains and Trading Success.

_______________________________

Contact Me for your Free 10-Day Trial or for your Subscription Service Invoice Today!

All Payment Types Processed by PayPal.

Bank Transfer Also Available.

Your Mentor

Duane Shepherd

(M.Sc. Economics, B.Sc. Management and Economics)

Currency Analyst/Trader

shepherdduane@gmail.com /(876)-3825648

Twitter: @WorldWide876

Facebook: DRFXTRADING

________________________________

________________________________

Good topic, this is going to help a lot of people get the whole concept

ReplyDeletebinary options brokers

The best way to know and do Forex trading google, just involve and surf the website. It is a very secure way of trading.

ReplyDeleteTradorax experience