USD CAD RALLY ACCURATELY PREDICTED IN PRIVATE VIDEO LESSON - 12 HOURS BEFORE THE BOC RATE DECISION!

The comments from the Bank of Canada this morning which implied the need for continued low interest rates for the economy, had the expected effect of leading to sharp losses for the Canadian Dollar - reflected in a USD CAD rally - within a time span of just 4 hours (low or the expectation of lower Interest Rates reduces the demand for a currency). However, as you can see from the screenshot of the Private Video Lesson for DRFX Subscribers, this rally was accurately predicted 12 hours before it actually took place using only Japanese Candlestick Patterns and Consolidation Setups.

This was further proof that mastery of these tools on the Daily and 4 Hour Charts is all you really need to be profitable in this Trillion Dollar Market, without the need to analyse or even understand these important Economic News events!

The accuracy of this forecast was based on the knowledge and use of just 2 key Technical Factors from the Trading Manual that allow us to understand and anticipate major market movements on the Forex every week.

1. COUNTER TREND LINE SETUPS

Based on the current Downtrend on the Daily Chart, the market was expected to pullback to form another Counter Trend Line Setup a seen in the graph below and in the screenshot of another Private Video Lesson..

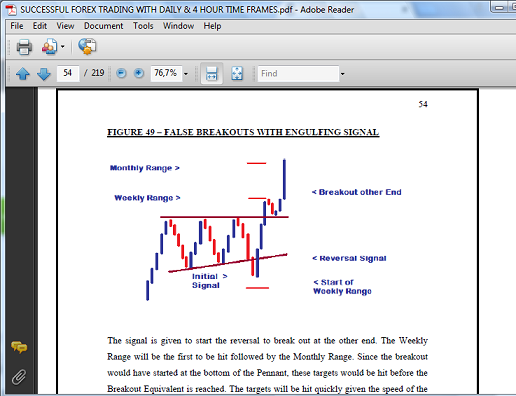

2. FALSE BREAKOUT REVERSALS

This was the Pennant Setup seen on the 4 Hour Chart. Knowing that the Daily Chart required a pullback meant that we knew the Bearish Breakout was unlikely to be successful and that the more likely scenario was a False Breakout Reversal back inside of the Pennant.

THEORY OF FALSE BREAKOUTS FROM THE TRADING MANUAL

So simply knowing these 2 factors within the context of how the Daily and 4 Hour Charts work together would have been enough to confidently avoid Shorting and subsequently losing on this pair. (Not traded Long either - rally expected to be temporary. Also risky to trade against the trend).

The reversal also showed that - contrary to popular belief - once you have a firm grasp of these and other major technical factors that actually control the Forex Market each month, you really do not need to know anything about Economics, Regression Analysis or other complicated Forecasting Techniques to be successful at Forex Trading over the Long-Term.

This was further proof that mastery of these tools on the Daily and 4 Hour Charts is all you really need to be profitable in this Trillion Dollar Market, without the need to analyse or even understand these important Economic News events!

USD CAD 4 HOUR CHART FORECAST PRIVATE VIDEO LESSON SCREENSHOT

4 HOUR CHART REVERSAL

1. COUNTER TREND LINE SETUPS

Based on the current Downtrend on the Daily Chart, the market was expected to pullback to form another Counter Trend Line Setup a seen in the graph below and in the screenshot of another Private Video Lesson..

DAILY CHART USD CAD

2. FALSE BREAKOUT REVERSALS

This was the Pennant Setup seen on the 4 Hour Chart. Knowing that the Daily Chart required a pullback meant that we knew the Bearish Breakout was unlikely to be successful and that the more likely scenario was a False Breakout Reversal back inside of the Pennant.

PRIVATE VIDEO LESSON SCREENSHOT

THEORY OF FALSE BREAKOUTS FROM THE TRADING MANUAL

So simply knowing these 2 factors within the context of how the Daily and 4 Hour Charts work together would have been enough to confidently avoid Shorting and subsequently losing on this pair. (Not traded Long either - rally expected to be temporary. Also risky to trade against the trend).

The reversal also showed that - contrary to popular belief - once you have a firm grasp of these and other major technical factors that actually control the Forex Market each month, you really do not need to know anything about Economics, Regression Analysis or other complicated Forecasting Techniques to be successful at Forex Trading over the Long-Term.

________________________________

Your Mentor

Duane Shepherd

(M.Sc. Economics, B.Sc. Management and Economics)

Currency Analyst/Trader

shepherdduane@gmail.com /(876)-3825648

Twitter: @WorldWide876

________________________________

There are many well-intentioned Forex Courses and Mentors globally. However, most fall short of the mark in terms of what you really need to take advantage of the Forex because of the limited Testing and Research that went into creating their Systems.

This is why they only work in the Short-Term.

To correct this, you need to have a totally new approach from the ground level with theories that have been extensively tested for 10 years, during both Normal and Abnormal market conditions.

This is what you will finally get as a DRFX Subscriber.

________________________________

Comments

Post a Comment