PROJECTED PENNANT FORMED ON EURO USD DAILY CHART - STRONG BREAKOUT AHEAD?

This pair has

now formed the predicted Pennant Setup on the Daily Chart and has now resumed

the bearish breakout from the larger Pennant Consolidation. There had been an

initial Counter Trend Line (CTL) Setup that was broken in an attempt to resume

this downtrend, but because of the weak nature of the candles and the

subsequent Bullish Candle, a Pennant was forecast to be formed. This tends to

happen when CTL breaks are weak and knowledge of this dynamic of the market can

be used to avoid pullbacks that can take out trades.

GENERAL MARKET

PATTERN

As can be seen

in the chart below, a break out has started from the large Pennant formed in

the aftermath of the Financial Crisis and safe-have flows of 2008.

DAILY CHART -

PENNANT CONSOLIDATION

Given the size

of this Consolidation and the general theory behind Consolidation Breakouts,

the gains for the USD are likely to continue for the rest of the year as we

head towards the next major Support of 0.8230.

DAILY CHART - FORECAST

BREAKOUT TARGET

The chart below

shows the break of a CTL setup that appeared set to lead to another bearish

move as part of this major breakout.

DAILY CHART - COUNTER

TREND LINE BREAKOUT

The initial

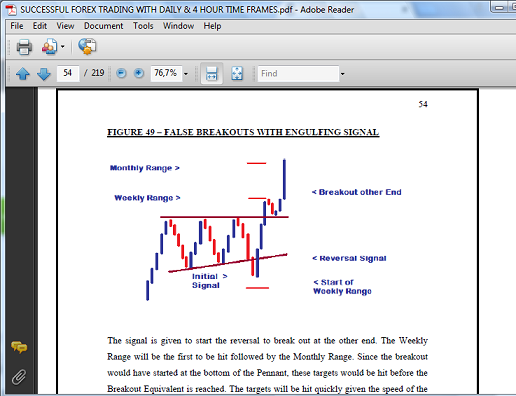

breakout candle was bearish but was too weak to justify entry. This was

followed by an opposing Bullish Candle that took out that Bearish Candle.

Reversals like this tend to take place when initial breakout signals from

Counter Trend Lines and Consolidations are too weak. These weak signals are

normally followed by reversals that take them out which can lead to;

1. A Stronger Signal

2. The Formation

of another setup

3. A Trend Reversal

Given the

strength of the overall downtrend, the formation of another setup in the shape

of a Pennant was predicted - the norm with weak breaks of Counter Trend Lines.

DAILY CHART - PROJECTED

PENNANT & BREAKOUT

After pulling

back higher and then U-Turning bearish, the formation of the Pennant was

completed a few days ago. This was then followed by a break of the Support that

could now lead to the resumption of the downtrend.

DAILY CHART - PENNANT

FORMED

MARKET FORECAST

Having formed

this Pennant and now broken the Support, there are two possibilities that lie

ahead. Given the weak nature of the breakout candles, we could have yet another

reversal that leads to another, stronger Consolidation Setup.

DAILY CHART -

LARGER PENNANT TO BE FORMED?

On the other

hand, this downtrend has been characterized by weak candles which have still

led to profitable moves since it began in May of 2014. As such, it is very

possible that the current small candles lead to another round of 400 Pip gains

for the USD towards the end of April (the average Weekly Range

DAILY CHART - BREAKOUT

PROJECTION

SWING TRADERS GUIDE

Although a

profitable move may come with these weak candles, the guidelines for the Swing

Trading Methodology remain the same - only trade strong breakout Setups with

Normal Candles. Since there will always be other Currency Pairs and stronger

setups from which to choose, there will never be a need to change one’s

strategy. This market will always

provide opportunities that are in sync with the Methodology and these always

“compensate” for the sacrifice of letting some trades pass us by.

Comments

Post a Comment