LAST GASP AUSSIE RALLY AHEAD OF SHARP DECLINE

The Aussie-Dollar pair has definitely been testing the patience of traders over the last few weeks, with an extended period of Consolidation above the most recent Uptrend Line. This period of market indecision could either be a setup to resume the current uptrend, or lead to the break of the Uptrend Line to start a downtrend. With the Monthly Range of this pair having been hit (see Trade Manual) and the possible formation of an even larger Pennant taking place, a bearish reversal looks to be the more likely outcome for the rest of 2014.

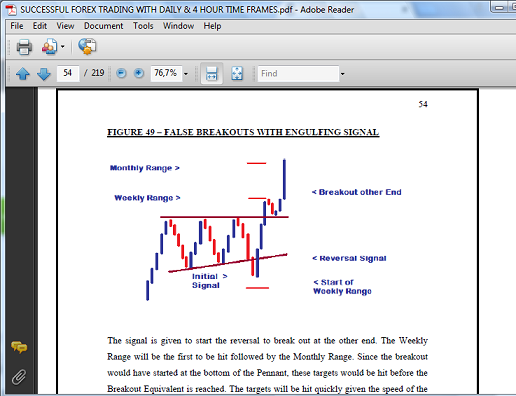

Both a Pennant and a Small Range have now been formed as the pair slowly drifts sideways below the Uptrend Line. The rally between 1 and 2 and then between 3 and 4 represented the 2 Weekly Ranges that completed the Monthly Range. As with all currency pairs, strong periods of Consolidation are normally formed ahead of either a resumption of the trend or that start of an opposing one.

One reason to support a bearish bias is the fact that we were in a large downtrend that formed with the breakout from a Pennant in 2013. Previous trends can still continue even when the Trend Line has been broken.

A 2nd reason to expect the depreciation of the Aussie currency is that there have been 3 successive waves of Uptrends and Downtrends that are usually indicative of a large Consolidation setup being formed. The bearish breakout below this Uptrend Line would be the fourth wave and the one that would create the 2nd Resistance point of the Pennant.

DAILY CHART - NEW PENNANT?

Finally, the break of this Uptrend Line is likely to take place based on one of the peculiar aspects of the currency market. Sometimes when there is about to be a trend change, the market will make a last gasp new high or low that changes the angle of the existing Trend Line. When this happens, the market will then break this line to start the new trend.

The previous Uptrend Line was formed by connecting the S1 and S2 Support points, but when the new high was formed, the 2nd connecting Support point changed to the one below the Pennant.

DAILY CHART - NEW HIGH & TREND LINE

Several other examples of this can be found across all time frames and with all currency pairs.

DAILY CHART - EURO USD

4 HOUR CHART- USD CAD

15 MINUTE CHART - NZD CHF

These types of Trend Line changes may be thought of as mere coincidences, but the frequency with which they occur makes this unlikely. Traders can use this knowledge to anticipate a trend change especially if the existing trend has had a very long run followed by a period of Consolidation.

The fact that several of the most popular and liquid currency pairs have also been in Consolidation supports the bearish scenario for the Aussie Dollar. Trends have been few and far between in an environment of low volatility and minimal interest rate differentials. Therefore, identifying and knowing how to trade these setups will allow traders to continue to make money.

RECENT EMAIL FROM CLIENT

____________________________________________________

SUBSCRIBE TODAY

Comments

Post a Comment